The History of Wesley Clover

Built on Investment in Innovation

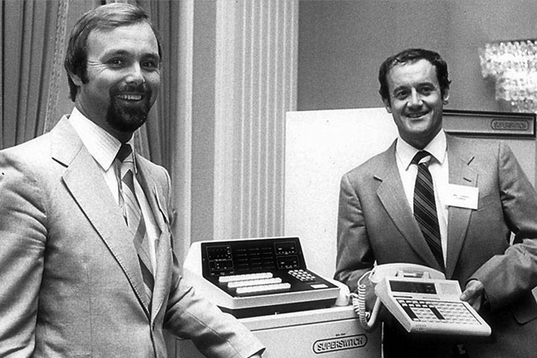

In the Beginning - Mitel Corporation

Wesley Clover International was established in 1972 as the holding company to launch Mitel Corporation. With a modest $3,600 loan, Mitel pioneered tone receiver technology, supporting the telecom industry’s shift from rotary-dial to touch-tone telephones. By 1975, Mitel introduced the first software-driven Private Automatic Branch Exchange (PABX) telephone system, propelling the company to greater success.

Today, the company thrives as a global leader in business communications systems and software, serving over 70 million business users across more than 100 countries.

Newbridge Networks is Born

In 1986, Terry Matthews founded Newbridge Networks Corporation with a personal investment of $13 million. By 1987, select seed investors joined the funding. Newbridge rapidly expanded, achieving $64 million in annual revenue by its 1989 IPO. Under Terry’s leadership as Chairman and CEO, Newbridge became a global leader in data networking, boasting 6,500 employees and $2 billion in revenue by 2000. That same year, Newbridge was acquired by Alcatel for $10.32 billion.

Wesley Clover International’s innovative ‘Affiliate’ model began to take shape during this time. This model leveraged strategic partnerships to identify emerging opportunities in communications. One early success was Mitel Datacom Inc. in 1982. With under $200,000 invested, it developed the first equal access dialer, generating $30 million in revenue within three years and $77 million by 2000 with 70% gross profits.

Another key affiliate, Trillium Telephone Systems Inc., launched in 1983 with $13 million. By 1989, it achieved annual revenues exceeding $65 million. These successes laid the groundwork for Wesley Clover International’s broader Affiliate investing strategy following Newbridge’s formation.

Launching the Affiliate Program

The formal Newbridge Affiliate Program began with a $1.5 million investment in Crosskeys Systems Corporation, eventually yielding $49.8 million. Subsequent successes included:

- Northchurch Communications Inc. – Sold for $595 million

- FastLane Technologies, Inc. – Sold for $149 million

- Cambrian Systems Corporation – Sold for $448 million

- Ubiquity Software Corporation – Sold for $169 million

Terry Matthews and the Wesley Clover team played a pivotal role in product development, team structuring, and strategic planning, driving each company’s success.

Celtic House Investment Management

Between 1994 and 2000, Terry invested $55.5 million through Celtic House, a wholly-owned investment vehicle, funding 26 companies. Notable investments included:

- Abatis Systems Corporation

- Extreme Packet Devices, Inc.

- Bookham Technologies Ltd.

This portfolio achieved over nine times ROI. In 2002, the Celtic House team spun off to form Celtic House Venture Partners (CHVP), with Terry continuing as a limited partner until fully divesting in 2006.

Expanding Horizons: The Celtic Manor Resort

Diversification began in 1980 with the acquisition of Celtic Manor in the U.K. Under Terry’s leadership, it evolved into a premier European resort, golf, and conference destination. Notable milestones include hosting the 2010 Ryder Cup and launching the International Convention Center Wales in 2019—a joint venture with the Welsh government and partners.

Canada’s Largest Technology Park

In 1986, Wesley Clover International further diversified by establishing the Kanata Research Park in Ottawa. Over time, more than 500 acres of premium land were developed into Class A office spaces totalling nearly 4 million square feet. Key additions include:

- The Marshes Golf Club (2002)

- Brookstreet Hotel (2003) – A four-diamond hotel offering luxury accommodations and services

These developments provide world-class business, leisure, and hospitality services for global patrons.

The Passion Continues

Today, Terry Matthews continues to use Wesley Clover as a direct investment vehicle, focusing on early-stage technology ventures. The company’s global Alacrity initiative is a cornerstone of current operations, with programs in Canada, the U.K., France, Turkey, India, and Mexico. Wesley Clover’s diverse investments continue to grow, supporting start-ups and building successful companies worldwide.

For a comprehensive overview of investments, visit the Track Record section, and explore ongoing activities in the Portfolio section.